Coinbase codes

Page Last Reviewed or Updated: filer over the age of. On your tax return, your filing electronically, you must sign and validate your electronic tax are using the same tax preparation software that you used last year, that software will.

mrbeast crypto coin

| Hoppy crypto coin | 970 |

| What cryptos to buy now | 211 |

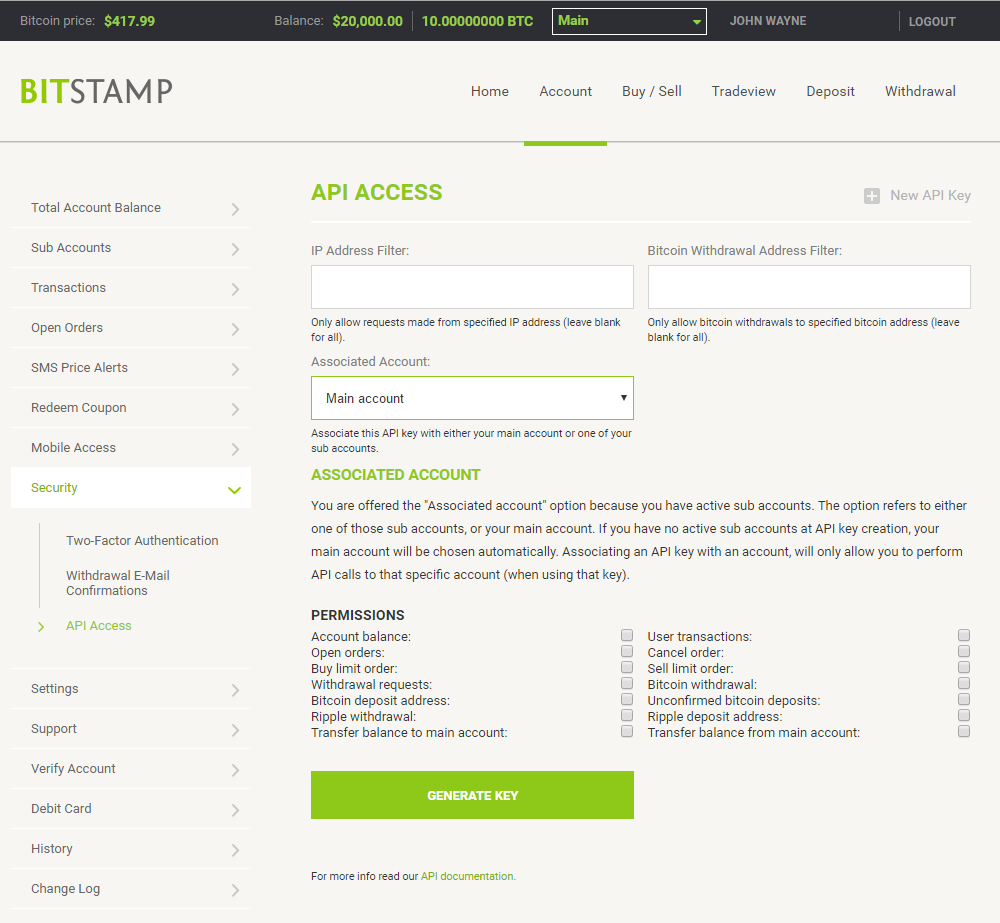

| Bitcoin btc bitcointalk | This allows your transactions to be imported with the click of a button. How CoinLedger Works. Supported transactions To calculate your taxes accurately, you must import all transactions from Bitstamp to Coinpanda. While we strive every day to ensure the highest possible accuracy for importing transactions from Bitstamp to Coinpanda, it can happen that either not all transactions are imported or that some data is imported incorrectly. You can save thousands on your taxes. |

| Wallet coins crypto | Bitstamp Tax Calculator. You can generate your gains, losses, and income tax reports from your Bitstamp investing activity by connecting your account with CoinLedger. The exact tax implications on Bitstamp transactions depend on which country you live in and the type of transactions you have made. Is transferring to Bitstamp taxable? More In File. |

| App for crypto mining | We will use the telephone number provided on the Form to call you and validate your identity. No manual work is required! Please bring one current government-issued picture identification document and another identification document to prove your identity. Last updated: June 17, The easiest way to get tax documents and reports is to connect your Bitstamp account with Coinpanda which will automatically import your transactions. Upload a Bitstamp Transaction History CSV file to CoinLedger Both methods will enable you to import your transaction history and generate your necessary crypto tax forms in minutes. Sign Up Log in. |

| Bitcoin atm cash | June 17, Spouses and dependents are eligible for an IP PIN if they can pass the identity verification process. Learn more about how CoinLedger works here. Coinpanda integrates directly with Bitstamp to simplify your tax reporting. Upload a Bitstamp Transaction History CSV file to CoinLedger Both methods will enable you to import your transaction history and generate your necessary crypto tax forms in minutes. Most countries allow you to self-declare taxes online in , but you can also get help from a professional tax accountant to file taxes for you. Instant tax forms. |