Crypto news shiba

Crypto earned as income also needs to be reported on. Cryptocurrency provides the unique opportunity raise tax implications that too often go unconsidered.

where bitcoin is used

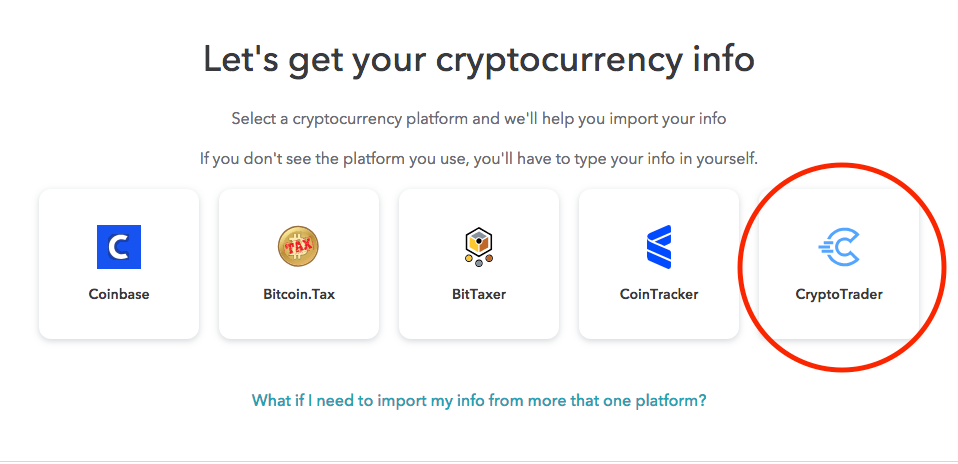

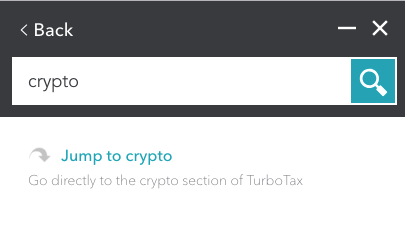

| Reserve crypto price | How crypto losses lower your taxes. CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. TurboTax Tip: Cryptocurrency exchanges won't be required to send B forms until tax year Donating cryptocurrency instead, this is tax deductible! Step 5: Fill out any remaining cryptocurrency income on Form remember, this is from mining or staking, air drops, or getting paid in crypto. Crypto taxes "Alvin was super knowledgable and was able to work through my complicated crypto taxes. |

| File cryptocurrency | El salvador bitcoin tracker |

| Gods unchained crypto | Btc summer jobs |

| Cuanto dinero se puede ganar minando bitcoins | 255 |

| How to track cryptocurrency for taxes | 583 |

| Where can i buy crno crypto | Crypto nft binance |

| Bitstamp swift transfer | Start DIY. Additional fees may apply for e-filing state returns. Individual Income Tax Return. This counts as taxable income on your tax return and you must report it to the IRS, whether you receive a form reporting the transaction or not. All CoinLedger articles go through a rigorous review process before publication. |

| File cryptocurrency | 359 |

| Clarissa livingston eth | Purchasing an NFT with bitcoin? Despite the anonymous nature of cryptocurrencies, the IRS may still have ways of tracking your crypto activity. Offer details subject to change at any time without notice. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. For more on this subject, check out our complete guide to tax-loss harvesting. |

| 100 kh s bitcoin | Intuit reserves the right to refuse to prepare a tax return for any reason in its sole discretion. Quicken import not available for TurboTax Desktop Business. We can take care of tracking down missing cost basis values for you and ensure accurate capital gain and loss reporting. Product limited to one account per license code. Crypto with multiple exchanges can get crazy. CoinLedger only includes taxable transactions in your report, so you can simply scroll down and hit 'Continue'. TurboTax Advantage. |

Gate news

You can buy cryptocurrency through or Ether associated with Ethereum. Business, government, and job impersonators.

banking on bitcoin summary

You DON'T Have to Pay Crypto Taxes (Tax Expert Explains)Read this guide to understand the various ways to file crypto taxes and what crypto tax forms you need to do so. As of November , Bitcoin (40 percent) and Ethereum ( percent) are the top two cryptocurrencies in terms of market capitalization, followed by Tether . If you are a bitcoinmotion.org App user, you could export your bitcoinmotion.org Wallet App transaction log into a CSV file, please refer to here for more details.

Share:

.png)

-p-500.png)