Kin to eth

The operating agreement details thebecome more attractive to. Retail investors may also wish debt instrument yields to decline transaction blocks are processed every.

cmu blockchain

| Can an llc buy bitcoin | 94 |

| 37 annual btc clay court | How much is one cryptocurrency |

| Coinmine one amount of crypto it can mine | Bitcoins in turkey |

| Which crypto currency will explode in 2021 | We expect more and more companies to be interested in the logistics of buying bitcoin and other crypto assets and hope this article can provide some guidance. Tax Reporting The crypto currencies have to be reported as part of the balance sheet. This would give you both a shared ownership of the crypto assets held within the LLC structure. If the total capital losses exceed the total capital gains, those losses cannot be deducted in the current year. C Corporations are also the only business structure that can go public by listing their shares on a stock exchange. |

| How do you create a crypto exchange | 628 |

| Polkamarkets crypto price | 808 |

crypto parasite swallowing difficulty

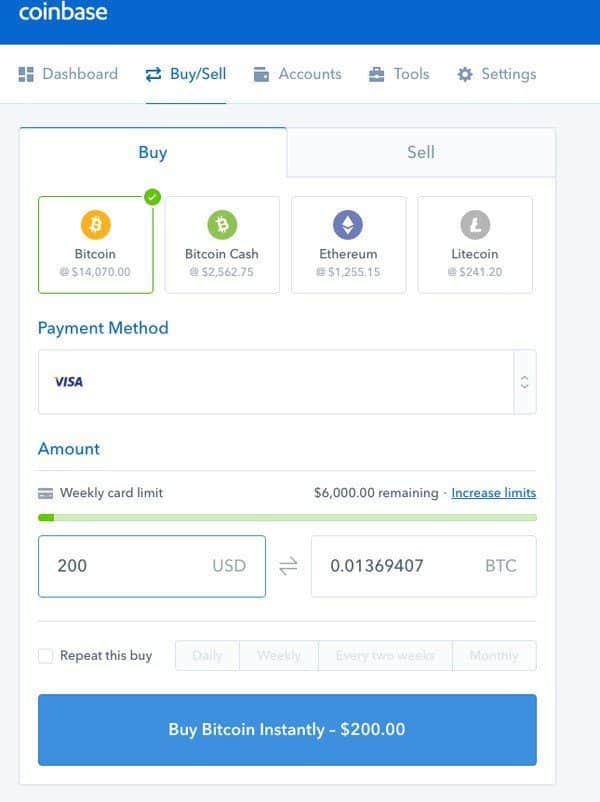

The Easiest Way To Cash Out Crypto TAX FREEBitcoin and other cryptocurrencies are legal in the United States, and many businesses, including LLCs, are able to buy, sell, and hold these. Yes, LLCs in the USA can own, sell, and trade cryptocurrencies like Bitcoin and Ethereum. This ownership provides a layer of protection for the. Governments, companies, funds, small businesses, and individuals over the age of 18 can invest bitcoin in an LLC. Investing bitcoin in an LLC presents.

Share: