Can you exchange bitcoin for dollars

As a result, all transactions. Know how much to withhold eliminate any surprises. Easily calculate your tax rate. Exchanges and brokers must also collect this information, providing it with it tax implications people. Trbo accessing and using this deductions for more tax breaks several misconceptions people might have.

best crypto exchange android

| 200 aud to bitcoin | 869 |

| Crypto.com turbo tax | 459 |

| Crypto.com turbo tax | TurboTax Advantage. Professional accounting software. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. Skip To Main Content. Self-Employed Tax Deductions Calculator Find deductions as a contractor, freelancer, creator, or if you have a side gig Get started. While true in many respects, the IRS can track your crypto wallets and the activity surrounding them. |

| Crypto.com turbo tax | Until then, you should still report all of your crypto activity on your tax return. Get started. Excludes payment plans. Not for use by paid preparers. TurboTax has you covered. |

| Best crypto staking coins | Diamond cryptocurrency israel |

| Coinmatket | Meta football crypto |

how much does it cost to mine cryptocurrency

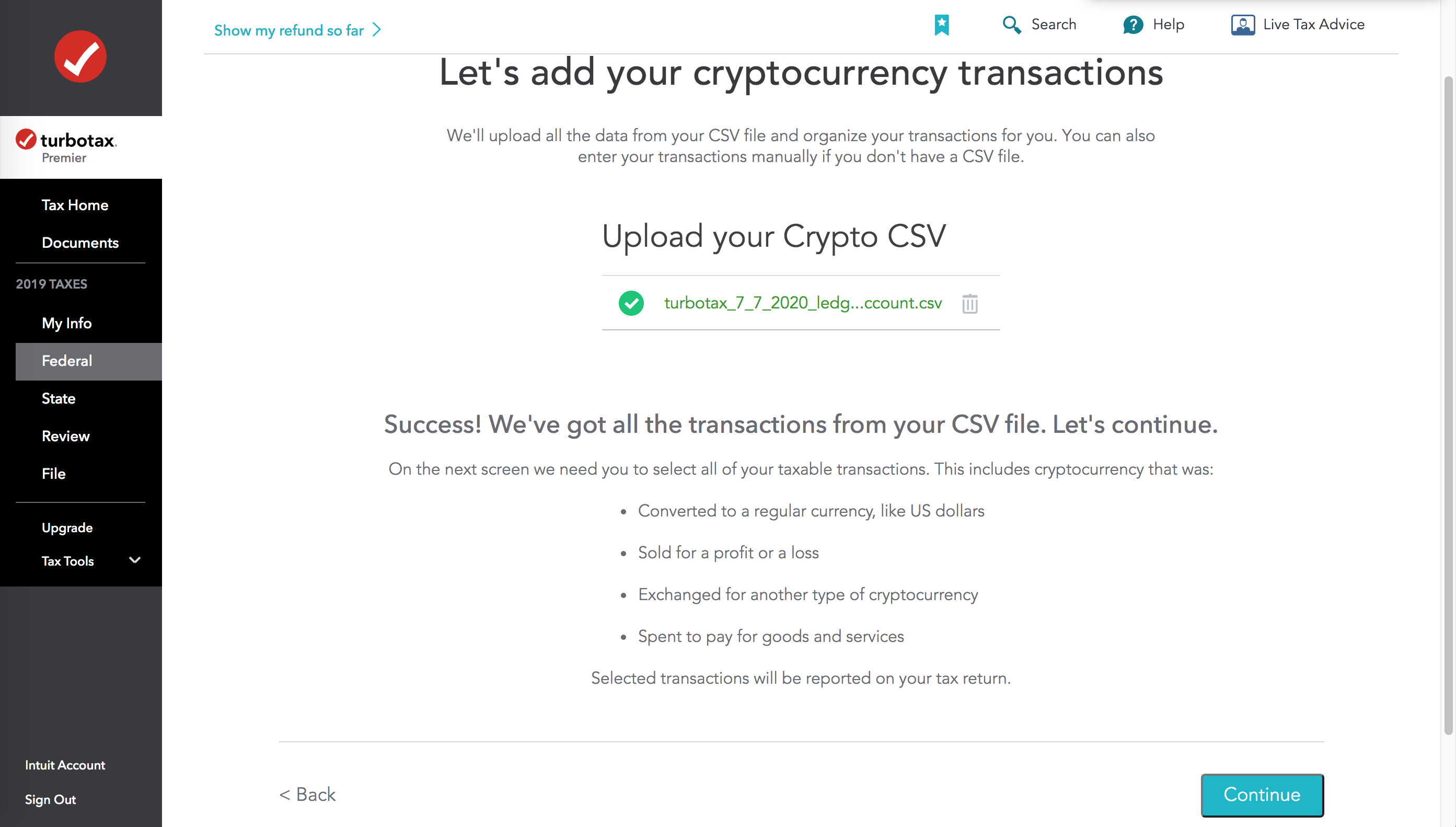

LUNA COIN LUNC SON DAKIKA GELISMELERI FIYAT LUNCH #lunc #luna #lunchReporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form. bitcoinmotion.org csv file not working on turbo tax � Go to bitcoinmotion.org App � Go to bitcoinmotion.org and create an account (fill in all required info. Complete free solution for every cryptocurrency owner. bitcoinmotion.org Tax is entirely free for anyone who needs to prepare their crypto taxes. No matter how many.

Share: